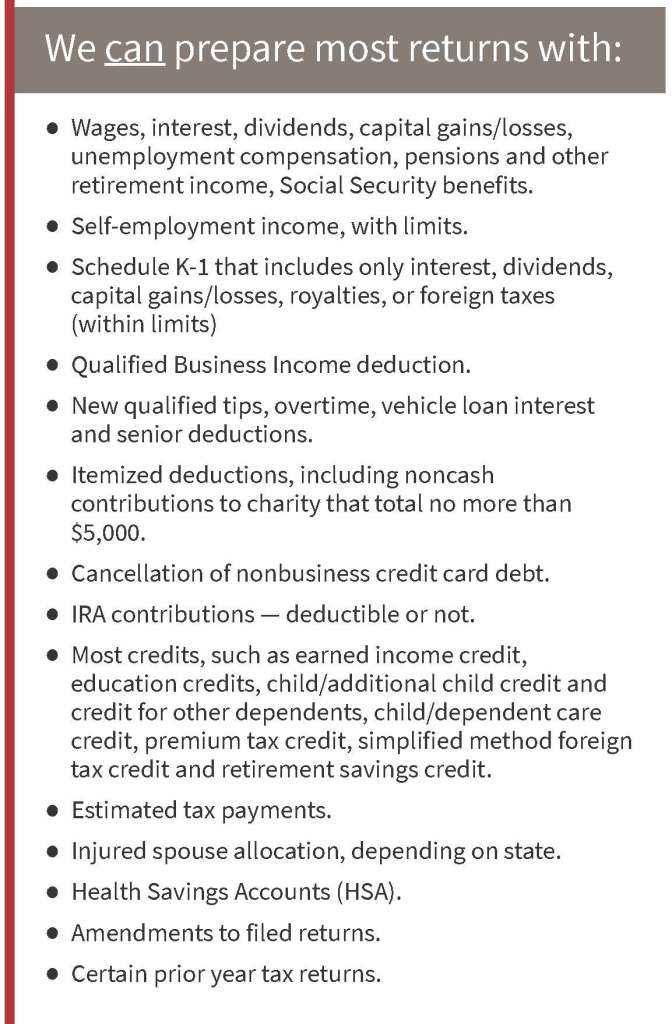

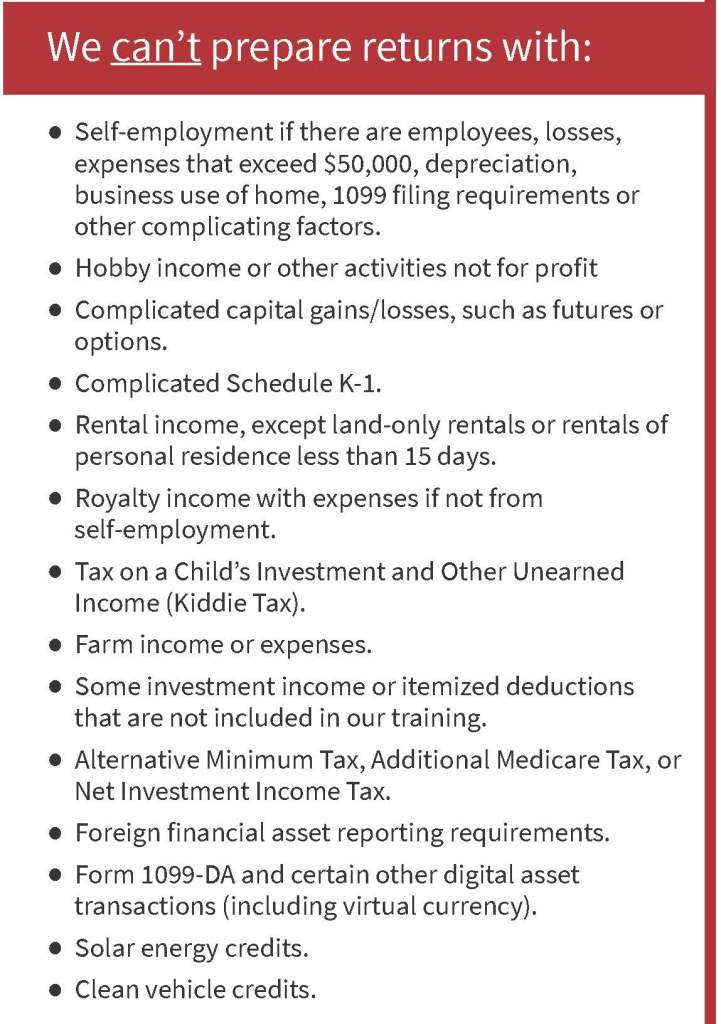

Volunteers with the AARP Foundation’s Tax-Aide program will be available to prepare income tax returns from February 2 through April 15. This free community service is open to people of all ages, with emphasis on assisting area seniors and those in need.

For Brazos Valley residents we have three service sites: the Clara B. Mounce Library in Bryan, Larry J. Ringer Library in College Station, and St. Mary’s Catholic Church in Brenham.

LET’S GET STARTED! Please review and follow ALL the steps below.

1. Schedule an appointment, either online or by telephone.

To self-schedule online (preferred for the Bryan and College Station sites; not available for Brenham), go to one of the links below:

- For the Mounce Library Bryan: https://tinyurl.com/BryanAppt

- For Ringer Library in College Station: https://tinyurl.com/CoStaAppt

Select your preferred date for an appointment AFTER today, and you will be shown the available times. If these times don’t work, select a later date and look again. Select your desired time and click Make Appointment at the bottom of the list. Next you will be asked to enter your name, email address, and phone number. There is no need to enter your birthdate. In the Notes box indicate the year for which the tax return is being prepared. Once you review and confirm, you will receive an email to verify. Make a separate appointment for each additional tax year and taxpayer. (A joint return is completed in one appointment.)

To Schedule by telephone, beginning Monday, January 26:

- Call 979-217-1778 for the Mounce or Ringer Library. Available to take calls: Monday, 9am-1pm, Wednesday, 9am-1pm, Thursday, 9am-1pm, Friday, 9am-1pm, and Saturday, 9am-1pm. That’s 9 to 1 every day, except Tuesday and Sunday.

- Call 979-836-4441 for the Brenham location at St. Mary’s Catholic Church. Call 9am to 5pm, Monday through Friday. Appointments are available February 5 and 19; March 5, 12, 19 and 26; and April 9.

If the line is busy or there is no answer, don’t immediately redial. Wait a few minutes before trying again. We cannot return messages. Some Internet providers’ phone services may not connect with our number. If you are unsuccessful, try calling from another phone system.

2. Obtain a Tax-Aide information packet if you haven’t already done so. You may obtain a printed packet at any one of the three locations. The contents are also available online:

- For the Bryan-College Station sites, go here to download the Tax-Aide instructions. The instructions in Spanish are here

- For the Brenham site, download this packet in English or this packet in Spanish.

- In addition, you’ll need this booklet, a fillable Intake/Interview booklet (Form 13614-C). Simply download and save as a PDF by clicking the download arrow, open with Adobe Acrobat Reader (free program), complete on your computer, and print to bring to your appointment. Here’s the booklet in Spanish.

3. Prepare your packet for your appointment. Complete the forms and assemble your tax documents (W-2s, 1099s, etc.) before coming to your appointment. Be sure to watch for the tax-related documents that come in the mail, as we will need them to file your taxes. Also, please print the documents that you receive by email or download from a website.

- Fill in all 10 pages of the Intake/Interview booklet (except the gray shaded parts).

- Use the “Documents Needed” in the packet or download it here to assemble your tax documents.

- Bring a Social Security card for each person on your tax return.

- Place all the documents in a packet and print your name on the front cover.

4. On the day of your appointment be sure to bring the following: (a) your packet with all the completed forms and documents; (b) a picture ID to verify your and your spouse’s identity, and (c) your previous year’s income tax return. We respect your health concerns and will provide/wear masks at your request.

- A volunteer facilitator will verify your identity and interview you while reviewing your documents.

- A tax return preparer will meet with you to complete your return.

- A second tax preparer will review your return with you to double check everything.

- Following the review, you will be asked to sign a form to authorize filing your tax return electronically. For joint returns, both spouses must sign.

- Appointments generally take approximately 2 to 3 hours.

5. Other resources. We have additional worksheets available to help with other tax situations.

Itemized Deductions. To download a worksheet for Itemizing Deductions (Schedule A), go here. With the higher Standard Deduction, more taxpayers find it advantageous to take the Standard Deduction rather than itemize.

Self-Employment. If you are self-employed or received form 1099-NEC, you will find this worksheet to be helpful.

Education Credits. If you or your dependents are in college, then you will want to see if you are eligible for education credits. Start here.

6. New Tax Provisions. Some recent tax law changes, effective 2025-28, may benefit your 2025 tax return. Complete the worksheet if you might qualify.

> The new “No Tax on Tips” law allows a designated deduction for tips (up to $25,000) earned by workers where tipping is customary. The deduction phases out at higher incomes. Employee Worksheet. Self-Employed Worksheet.

> The new “No Tax on Overtime” rule will allow certain workers to deduct up to $25,000 of overtime pay but is subject to phase out depending on the level of income. Overtime Deduction Worksheet.

> Also new is the Car Loan Interest Deduction for new cars bought in 2025-28. The car must be assembled in the USA; the VIN is required; and it phases out at higher incomes. Vehicle Loan Interest Deduction Worksheet.

> An Enhanced Deduction for Seniors 65 and older will subtract an additional $6,000 each from their taxable income. This deduction phases out with higher income. No Worksheet Needed.